Compass Investors AdvisorAdvantage™

THE HORIZON™ ADVANTAGE FOR FINANCIAL ADVISORS

What's Different About HORIZON™

UNBIASED ANALYSIS LEADING TO SUPERIOR PERFORMANCE

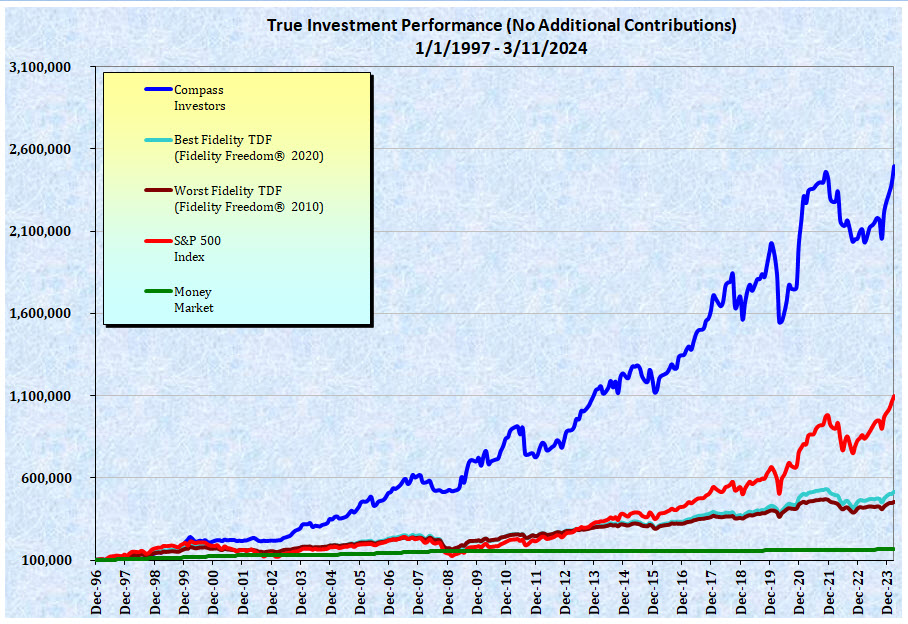

The most obvious difference, clearly seen in the chart below, is in significantly improved performance. The back-tested outcome of following an Adaptive Asset Allocation™ strategy is 2-3 times higher portfolio growth than even the best traditional asset allocation strategy.

"There seems to be little doubt about how well subscribers to the 401(k) trading service from Compass Investors...have fared"

--Jason Zweig, The Wall Street Journal

(9/7/13).

Any AAA strategy, such as the Compass Investors HORIZON™ service, differs from traditional asset allocation in 2 fundamental ways.

- More frequent reallocation. Unlike traditional asset allocation which might realign your investments between 1 and 4 times per year, AAA reallocates your portfolio 10-11 times per year.

- Investments aligned to market conditions. Unlike traditional asset allocation which aligns asset mix according to answers to a risk assessment questionnaire, AAA aligns your asset mix according to market realities. More...

Because of these two important distinctions, AAA's superior results have been obtained with the same amount, or in many cases, lower risk than traditional asset allocation strategies.

How does Adaptive Asset Allocation™

work? ![]()